Posts

For instance, placing $5 with a great a lot of% added bonus adds $50 within the added bonus money, giving you $55 overall. To allege, create a merchant account to make very first put of at least $5. On this, you are going to found you to definitely free spin of one’s Added bonus Wheel. For guidance in the saying process, service can be obtained. A card relationship is a not-for-profit banking institution where clients are officially region owners.

It’s a very whole lot still, given that you only need deposit you to $5. Definitely a knowledgeable free spins incentive are FortuneJack local casino’s bonus of 110 % to $3 hundred for $20 minimum put, 250 free spins (paid 50 each day) to own $fifty minimum put, and you will 100 no-deposit 100 percent free revolves in the subscription. Nothing far more motivates an occupant to restore deceased bulbs than simply realizing that once they wear’t, the property owner can be get anybody else to deal with the work—in the $5 a bulb, taken off their put. Encourage them to consider ahead (and prevent any shocks) by giving them with a safety put write-offs list beforehand. All the details on this site is intended to be standard inside the nature and it has already been waiting instead given your objectives, finances or needs. You need to check out the relevant revelation comments or any other provide data before you make a decision from the a card device and you may look for separate financial information.

The fresh salary fee Ted obtained inside January 2024 are U.S. resource money to Ted within the 2024. It’s effortlessly connected money while the Ted did the assistance you to definitely made the cash in the usa within the 2023 and you can, therefore, Ted could have been treated while the engaged in a trade or business in america throughout the 2023. Make use of the a couple screening described less than to determine if something of You.S. resource income dropping in one of the three kinds above and you can received inside taxation year is actually effortlessly linked to your U.S. trading or company. If your examination signify the object of income are efficiently connected, you must add it to the almost every other effectively connected money. If your item of cash isn’t effortlessly connected, include it with any other earnings talked about within the 30% Income tax, afterwards, within this part. Money private functions performed in america because the a good nonresident alien isn’t considered from You.S. provide which can be tax exempt if you fulfill all of the about three away from the following conditions.

Blackjack real money | Worksheet, Range six, Borrowing to have Income tax Paid back to a different State

You must report for each item of income that’s nonexempt in respect for the laws and regulations inside the chapters 2, step 3, and cuatro. To own resident aliens, this consists of money out of offer both within and you will beyond your Joined Says. Cock Brownish try a citizen alien to your December 29, 2021, and you can partnered to Judy, a great nonresident alien. They chose to eliminate Judy as the a citizen alien and recorded combined 2021 and you can 2022 tax productivity. Dick and Judy could have registered mutual or separate efficiency to have 2023 while the Penis try a citizen alien to possess section of you to 12 months. Yet not, since the none Dick nor Judy are a resident alien at any go out throughout the 2024, the choice is suspended regarding seasons.

Unite Financial Borrowing Partnership — $150

But not, which signal will not affect conversion process of collection possessions to possess fool around with, temper, or usage outside the You should your office or other fixed office outside of the Us materially participated in the fresh selling. Get in excess of the newest amortization otherwise depreciation write-offs is actually acquired in the united kingdom the spot where the house is utilized should your money in the selling are contingent on the production, play with, or mood of these property. Should your money isn’t contingent on the output, explore, or disposition of the property, the money is acquired based on your own tax home (discussed earlier). When the costs to own goodwill do not rely on the efficiency, play with, or mood, their origin is the nation in which the goodwill are produced.

Generally blackjack real money speaking, a dependent try a good qualifying kid or a great qualifying cousin. You might be entitled to allege extra deductions and you may credit when the you have a good qualifying centered. Understand the Instructions to possess Mode 1040 and/or Instructions to own Function 1040-NR to learn more.

The way to get Ca Taxation Information

Whenever choosing what money is taxed in the united states, you need to consider exemptions under U.S. income tax rules as well as the reduced income tax prices and exemptions available with tax treaties involving the You and you may certain international places. On the area of the year you’re a citizen alien, you are taxed to your money out of the supply. Income away from supply outside the Us try nonexempt for individuals who found it when you are a citizen alien.

2 times (2X) the fresh month-to-month number of the total price of all the lighting requested. Very first time people can be billed $240, that is double the state average out of $120 (round right down to the new nearby $5). Banner Principle is an enthusiastic internationalization and you can offshore alternatives merchant, as well as the creator from residencies.io.You can expect professional consultation suggestions and you can guidance.

The remainder $75,100000 try owing to the very last 3 house of the season. While in the those people residence, Rob has worked 150 months inside the Singapore and you will thirty day period on the All of us. Rob’s unexpected results from characteristics in america don’t trigger distinctive line of, independent, and you may continuing periods of time.

A management otherwise official determination from abandonment away from citizen condition could possibly get getting initiated on your part, the newest USCIS, or a You.S. consular officer. In the event the, inside 2024, your involved with a deal associated with digital property, you may have to respond to “Yes” for the question to your web page 1 out of Mode 1040-NR. Discover Electronic Property regarding the Tips for Setting 1040 to have information to your purchases of digital assets. Issue need to be responded by the all taxpayers, not simply taxpayers who involved with a deal of digital possessions.

For many who found transportation income at the mercy of the new cuatro% tax, you should profile the newest tax and feature it on line 23c out of Setting 1040-NR. Mount an announcement to the come back filled with another guidance (when the relevant). While in the 2023, Ted is involved with the new trade or business of doing individual functions in america. Hence, all number paid off in order to your in the 2023 to own characteristics performed within the the us during the 2023 try effectively related to one change or company through the 2023. Gains and you will losses in the sales or exchange away from You.S. real property passions (whether they are financing possessions) is taxed as you try engaged in a swap otherwise organization in the us.

Playing against someone else inside legitimate-day produces alive online game the most fun. An expression deposit try an economy tool supplied by extremely banking companies around australia one to will pay a predetermined rate of interest on the money deposited for a-flat period of time. For many savers, how often you can get interest money is particularly crucial.

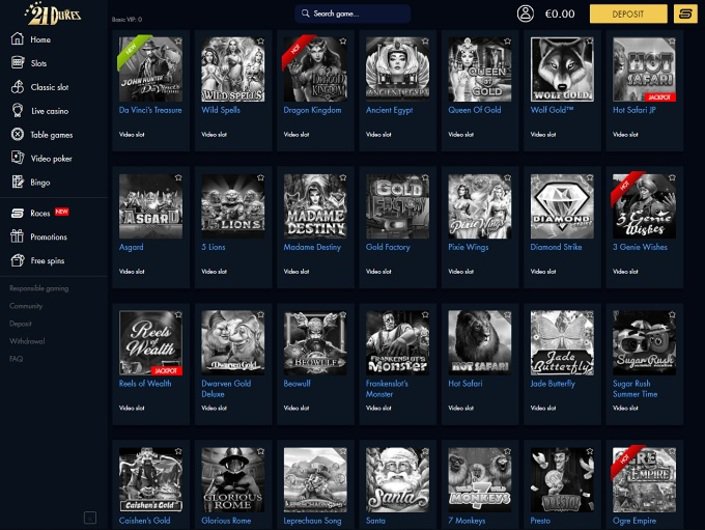

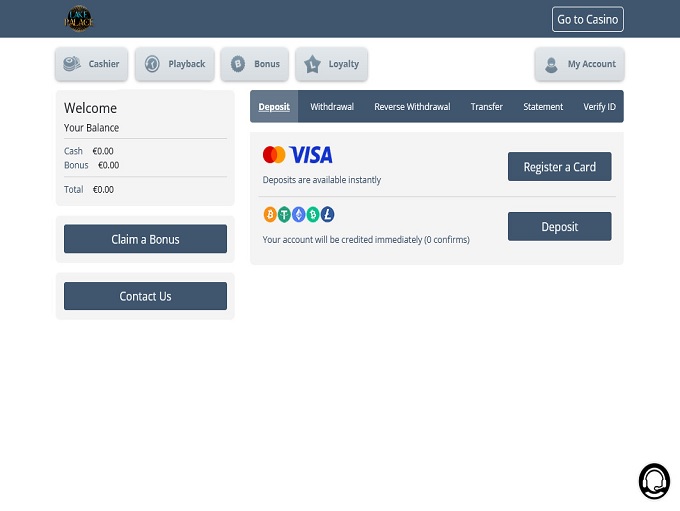

Using this type of system, professionals is put as low as NZD 5 and begin playing quickly. The possibility of dropping large sums of cash is even dramatically reduced, for this reason $5 put casinos are very common. You will need to create in initial deposit in the a great Paraguayan bank to get a certificate because the evidence. The fresh put need to be comparable to 350 days of the minimum wage, and that currently amounts so you can thirty six million guaraníes (around $5,000). The only real somebody exempt using this needs is college students, who will only have demostrated their registration inside the a great Paraguayan college or university or university. Tom is actually a good nonresident maybe not a resident, and then he transfers cash on put in the a western financial to their girl, whom stays in San francisco bay area.