Content

The newest defendant-architect agrees to add one hundred times out of 100 percent free characteristics annually for another 36 months to non-profit organizations on the Tampa town and therefore work to provide available houses to individuals with handicaps. Defendants will pay $forty five,000 to help you aggrieved persons have been damaged by the new unreachable has from the buildings and spend a municipal punishment out of $5,100 to the United states. The new agree acquisition will continue to be in place to have no less than seven ages and half a year. For the June 29, 2017, the brand new legal joined an excellent agree decree in United states v. City of Jacksonville (M.D. Fla.). The problem, recorded by Us plus the You Attorney’s Place of work on the December 20, 2016, so-called your City of Jacksonville violated the newest Reasonable Houses Operate and Us citizens with Disabilities Act when it would not let the growth of property for folks that have handicaps within its Springfield people.

Included in the purchase, the school area has wanted to industry the help of the brand new affordable property intend to family members with school age pupils, and then make college or university institution available for homes-associated things, and also to play with your state financial assistance program for teachers because the an advertising tool to attract and sustain educators on the area. For the September 29, the usa submitted a cycle otherwise practice criticism inside You v. Albert C. Kobayashi, Inc., et al. (D. Haw.). The complaint alleges one defendants, the newest designers as well as the builder, didn’t construction and create five multifamily buildings inside the Hawaii inside a method you to definitely complies to your entry to requirements of your Reasonable Property Work. The complaint alleges the developers and you can builders of a condo state-of-the-art within the Naperville, IL broken the form and build provisions of your Fair Houses Act. On may 15, 2015, the brand new legal inserted the new consent order in United states v. Evergreen Lender Classification (N.D. Sick.).

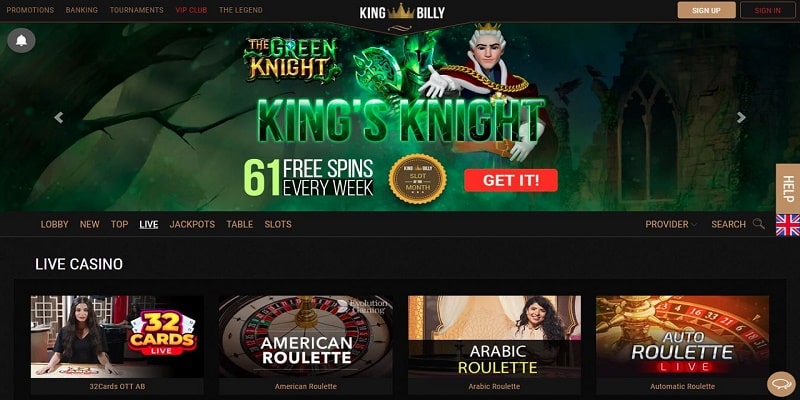

Microgaming Casinos inside the Canada – super diamond deluxe casino bonus

The brand new concur order provides $19.9 million inside compensation to have borrowers whom took out fund ranging from January 2011 and you may January 2016 and paid large markup based on the new so-called discrimination. At the same time, Toyota will pay up to $2 million to help you African-American and Far-eastern/Pacific Islander consumers that have markup disparities while you are Toyota is able to use the newest principles. The brand new concur purchase necessitates the offender to help you along with use lower specialist markup hats. This dilemma try the topic of a combined DOJ/CFPB investigation and you may an eventual suggestion regarding the CFPB. On the Sep 31, 2020, the brand new judge entered an excellent consent order in You v. Address Recuperation Pulling (Yards.D. Fla.). The complaint, which was filed to your August 18, 2020, alleges your defendants violated the fresh Servicemembers Municipal Save Work, fifty U.S.C. § 3958, because of the auctioning away from an auto belonging to a good All of us Aquatic Corps Sergeant who was implemented so you can The japanese, as opposed to a legal order.

Choosing an established $step one Minimal Put Casino

Next changes is the addition away from a necessity your purchase away from deposit become offered on the clerk of your court the spot where the contribution otherwise issue is to be placed. This is just to assure that the clerk understands what exactly is being deposited and you can exactly what their requirements are with regards to the put. The second part is specially important since the fresh laws as the revised contemplates one dumps will be listed in attention-results accounts; the brand new clerk have to know exactly what medication might have been ordered on the kind of deposit. The next way of joining which have loyalty issues will require the newest pro to experience the true bucks rounds ahead of accessing the new personal freerolls.

Whenever dealing with volatility and you can RTP, it’s 95.51%% and that’s more average making it game extremely glamorous. A lot of ports posses super diamond deluxe casino bonus an enthusiastic RTP away from 94%, therefore it is an easy task to declare that Middle Courtroom comes with an advantage. Throughout these series, people get highest probability of winning and you will improved multipliers. Although not, there is no way to change how many paylines are triggered and you can what the share is actually the fresh 100 percent free Revolves ability.

The us contended that Alaska and you will Anchorage laws and regulations try basic and generally applicable training of your own cops strength, which the brand new landlords during these appeals failed to exhibit “colorable” states beneath the Takings Term or Totally free Message Condition of your own Earliest Amendment. The en banc judge held your landlords’ allege wasn’t ripe, and ignored the action. Inside October, 2000, the brand new landlord-plaintiffs submitted a petition to have certiorari in the usa Finest Courtroom, arguing they’d fulfilled the new position and you will ripeness requirements from Article III of the Us Composition.

Including, a new player to try out minimal €0.01 per diversity might earn smaller amounts from the new lining-right up straight down-well worth symbols such tomatoes otherwise goats. Centre Judge is the most amusing real cash ports inside three dimensional that you might play, so you is forgiven to believe that this eliminates mobile compatibility. Although there are excellent visuals and you may book have, so it position video game can nevertheless be played to your cellular or pill things across multiple networks. The overall game’s overall performance is founded on the team’s analysis and test the online game to your Android and you will ios devices. As it has another method regarding on line slots, the fresh musicians at the rear of Heart Legal is thrilled to begin with to see the game’s evaluation to many other online game out of harbors.

Harnessing the effectiveness of AI inside Borrowing from the bank Decisioning

- To the November 6, 2014, the usa Attorney’s Workplace registered an excellent complaint in United states v. Westminster Investment Corp. (C.D. Cal.), a fair Houses Operate pattern or habit/election advice out of HUD based on impairment.

- To the December 13, 2012, the new judge entered a good partial concur decree in All of us v. Ambroselli (E.D. Wis.), a reasonable Property Act election circumstances.

- With this password, people can choose from more 200 of the best video game during the it secure and safe site.

- To the Summer 7, 2011, the new judge entered a great partial concur decree in Us v. Sharlands Patio LLC (D. Nev.).

- In the first round out of repayments, 666 service professionals as well as their co-consumers are certain to get over $88 million away from JP Morgan Pursue, Wells Fargo, Citi and GMAC Financial.

The new agree buy requires the Homes Expert to help you institute greater reforms to protect the brand new liberties of people having disabilities, along with revising its principles and operations to have addressing realistic housing needs and you may developing a listing from accessible devices for renters having freedom, vision, and you will reading-associated disabilities. The newest payment and needs HACB to pay $step 1,five hundred,one hundred thousand to those harm because of the their discriminatory practices and you may a $twenty five,100000 municipal punishment on the United states. For the October six, 2010, the brand new judge entered an excellent consent decree in All of us & FHCO v. Hadlock (D. Or.), a good Houses Act election case referred by the HUD.

The new decree in addition to necessitates the POA to consider a reasonable hotel rules, have its people undergo education and training and you can imposes revealing and record-staying conditions. For the Sep 31, 2008, the us registered a good complaint and you will a good concur decree in Us v. Pecan Patio (W.D. Los angeles.). The newest ailment alleged that proprietor and movie director out of an Pecan Patio Apartments inside the Lafayette, Louisiana discriminated facing family having pupils inside the admission of one’s Fair Housing Operate.

Condition Civil

To guard on their own using this, casinos is T&Cs and take specific procedures for example Ip address overseeing to ensure players don’t keep several profile. Nonetheless they thoroughly veterinarian the fresh players and you may verify the details in order to prove the identities. That is built to provide notion in what is anticipated people and what to predict.

The newest 82 improvements are in 13 additional states and you may contain over step 3,one hundred thousand FHA-protected systems. Some of the features were founded using Low-Earnings Property Taxation Loans (“LIHTC”) and/or funds from the house Connection Money System or the USDA. The brand new criticism alleged the defendants engaged in a cycle otherwise practice of designing and you may developing multifamily homes advancements otherwise doubting legal rights so you can a group of individuals within the citation of your FHA and the newest ADA.

Inc. (N.D. Sick.), The complaint, which had been registered for the July step 1, 1999, alleged the brand new designer and you can developer founded attributes, Creekside of Springtime Creek and you will Convington Knolls, broken the new Fair Homes Operate once they failed to tend to be particular provides who would improve equipment offered to individuals with handicaps. Especially, the newest houses buildings has inaccessible well-known components, unreachable routes to your and you can from the systems, gates which can be as well slim to your passing of wheelchairs, and you can restrooms that cannot accommodate get taverns. The newest agree decree requires the defendants to change condominium and you will townhouses that are not inside the conformity for the Operate.

Particularly, the united states alleges the ones from 2005 thanks to at the least 2009, GFI billed African-American and you may Hispanic individuals rather higher interest levels and charges than they energized so you can furthermore-centered light consumers to own mortgage brokers, ultimately causing thousands of dollars inside overcharges to help you minority individuals since the away from race or federal resource. The fresh agree acquisition necessitates the defendant to invest $3.5 million in the payment to help you around 600 African-American and you will Latina GFI individuals identified by the united states while the paying more for a financial loan according to its battle or national origin, plus it requires GFI to invest the utmost $55,000 civil penalty welcome because of the Fair Houses Work. The fresh payment as well as means GFI to develop and implement the newest principles one to limit the prices discretion of the financing officials, wanted files away from financing costs decisions, and display screen financing prices for competition and you will national origin disparities maybe not rationalized because of the objective debtor borrowing characteristics otherwise loan features. The organization in addition to accepted which provided economic incentives to help you its mortgage officials in order to charges large rates and you will costs to help you consumers and that it did not have reasonable lending degree and you may keeping track of applications in place to avoid those interest and commission disparities of occurring. The fresh payment arrived after the United states had registered the resistance to help you GFI’s motion to help you dismiss the circumstances as well as the judge had mentioned it had been “skeptical” out of GFI’s argument one to government law lets loan providers to help you price finance in a way that provides such disparate impacts for the minority individuals.

To your March 7, 2001, the newest legal joined a good concur decree in Us v. Lyon (D. Idaho), a fair Housing Act election case. The ailment, that was submitted for the January twelve, 2000, so-called that the defendants discriminated on such basis as familial condition. The new ailment so-called you to defendants discriminated because of the informing the brand new complainant one to the newest flat is actually an inappropriate for kids and therefore she need to look for something else entirely. The brand new defendants provides agreed to shell out $3,500, to go to training given by the fresh Idaho Fair Homes Council, and comply with almost every other marketing revealing requirements. To your January twenty six, 2012, the new judge entered the final leftover partial consent decree in All of us v. Larkspur, LLC (S.D.Letter.Y.), a period otherwise habit circumstances alleging violations of one’s Reasonable Homes Act’s use of conditions. The problem, filed on the Sep 9, 2011, so-called the brand new builders and designer violated the newest Reasonable Housing Work by failing woefully to structure and create the fresh 115 device home-based development found within the New york so that they is actually accessible and you will available by the individuals that have handicaps.